On the heals of Nick Latin America's 10th anniversary, Sarah Baisley looks at how Latin America has become a booming market for TV animation.

An announcement that Nickelodeon was celebrating the 10th anniversary of Nick Latin America on Dec. 20, 2006, was a jarring reminder to television market veterans just how much the animated TV scene has changed in that region. That and how NATPE in January 2007 has chiefly become the destination to broker shows for Latin America seemed a good time to delve into this region to see what has been the impact of all-kids channels gaining a stronghold there in the past decade. AWM talked to some of the broadcasters and producer/distributors to get their perspective on changes in this region.

Some 25 years ago kids got a few half-hours to short blocks of cartoons from Hanna-Barbera, Disney and Warner Bros. broadcast on terrestrial channels, the biggest ones being Telemundo and Televista. Worldvision, then the distributor for Hanna-Barbera product, would fly out the creators during NATPE to sign autographs in their hospitality suites or booths, take photos with the walkaround characters and entertain channel owners at dinners at the top restaurants in the convention-hosting city.

Once a viewer in the region and now a seller to it, Luca Bentivoglio, president/ceo, Educational Adventures, recalls, "It was basically controlled by major terrestrial broadcasters with their kid's programming blocks. Depending on the country and their laws you had more or less hours of animation at different times. I remember when I grew up in Caracas, coming back from school to a very long afternoon block of animation with Warner Bros. and Disney product."

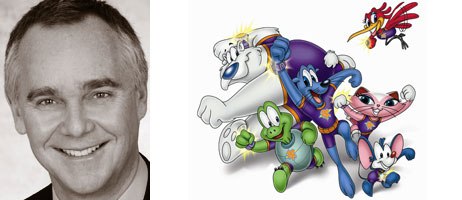

"In the last five years, I have seen a proliferation of product as well as outlets, said Bentivoglio. "I believe programming for kids has evolved considerably in the region and educational content is becoming more attractive to consumers in Latin America. In the case of The Danger Rangers, there are many opportunities to work with pan regional channels as well as terrestrial broadcasters. The alternatives are greater and competition is always healthy.

The syndication market drastically shrunk in the U.S. with vertical integration as major producers were allowed to buy their means of distribution (TV stations and networks) and consolidation became king. Cable rose to give viewers an alternative, but the majors then launched their own cable channels and found great success in the kids market with the all-toon Cartoon Network, Nickelodeon, Fox Kids (which became Jetix), The Walt Disney Co. (TWDC) Latin America and Discovery Kids.

The cable channels were welcomed by distributors, certainly by 20-year vet Ximena Rubio, sales manager for Salsa Ent., the distribution arm for Spanish-speaking territories of TV-Loonland. "What was great about that was that it became the first stop to premiere your programming." Admittedly it affected the company's terrestrial business, as those channels became more popular. "I think it's great those channels exist, because I like working with them. It gives you more avenues to sell to," he said.

"Now get yourself a diversified enough catalogue, which we are fortunate enough to have with TV-Loonland," he continued. "It allows you to fill the niche in each of those channels. If you have preschool then go to Discovery Latin America, which is very big on preschool. For the 6-8 age group, then you have Cartoon Network or Nick. It's important to have that," he said.

"My dream is to put a show on every one of the channels," said Rubio. "That would be something I'd call a wonderful day for me, when one day I open my avail book and in my avail book each of the channels has got one of my shows, at least one. Preferably I'd like them to take all of them!"

Another good advent for sellers is multiplatforms. While the U.S. is ahead of Latin America in this use, Latin American use is growing. "It's good for a distributor, it allows you more places to do work and sell," Rubio continued. "Now it's not just TV. Our primary business is television; the rest of the stuff is just what comes with the evolution of this business."

The outlets have increased by the license fees have not changed much in years. So points out, "You gotta remember that some of countries suffer unfortunately from economic, political, social problems that don't allow for there to be raising of fees. What they are going to make on advertising dollars on animation is not what they would make on film." He said kids don't draw advertisers because they are not the consumer with the money.

Rubio said he doesn't quite buy the argument some make that terrestrials won't want shows that premiered on cable. "Remember that children love to watch things over and over."

Anime has been a staple with Latin broadcasters who typically seek long runs of episodes (65+) at a lower cost than animation from North America or Europe, something the Japanese distributors have been capitalizing on as they have increased their market presence at shows over the past 15 years and major studios hold their product to launch on the cable channels first.

Tatiana Rodriquez, vp programming & creative strategy for Nick Latin America, says she grew up watching lots of anime. She and other regional experts AWM talked to agreed that the introduction of kids cable channels gave children a much greater variety of product to watch and created their own special places to be. Sellers had more outlets to sell to as each kids channel defined its own niche within kids programming. Given the success and longevity of each, there is room for all and the competition helps spur quality.

But not exactly amongst free TV. Rodriquez said those broadcasters thought, "Well now that all these cable channels are here, let them be the ones responsible for entertaining kids. Free TV stopped having the kids content blocks.

The down side is that many children in Latin America still do not have access to cable, it's a zone for the middle and upper class families. Free TV has been relying more on telenovellas and movies with a small amount of animation. Some did not want to run shows that had already premiered on cable. They wanted exclusivity.

"Regulations are beginning to come to some of the countries, requiring free TV outlets to broadcast a minimum amount of kids programming on open TV," according to Rodriquez.

For producers for kids shows there are more windows and new opportunities exposure of product. Rodriguez said, "I believe now that free TV now understands more and believes more than every how really important it is to have good content for the little ones. Kids have developed a real thirst for good, smart intelligent content."

On her schedule, 70% of the shows are originally produced by Nick, the rest is live and animation. At NATPE, Nick was showcasing Skimo, a live-action series produced in Mexico, airing on Televisa Canal 5. The half-hour comedy series has already wrapped up a second season in Mexico City. Rodriquez says they are looking to produce another live-action show in Argentina this year, as well as co-producing animation. Argentina is producing a lot of teens and tweens. Soaps for kids are a big production boom there she said.

"We believe you need to be true to region, to your creators and your audience," she said. "That's why we try to localize."

Some distributors have the impression that the channels only buy from major studios. She said she buys shows from medium and small producers. She recently has bought shows from Icon in Spain; Marathon, Alphanim and Method Films in France; as well as producers in Australia and the U.K.

Rodriquez believes there aren't more animated series from Latin America not for alack of great creators, but because the region lacks the animation infrastructure, that it doesn't have history and tradition of animation. Nick Latin America is trying to find ways support animators of the region and give them a screen. She's even looking into getting funding from Canada.

"Stay true to your mission and goals of your business and you will be well respected by your viewers," Rodriguez said, commenting on Nick's success in the region. "So we try to deliver the best content possible and support the creators in the region as much as we can.

MTV Networks Latin America Inc., a unit of Viacom Inc., owns and operates MTV Latin America, Nickelodeon Latin America, VH1 Latin America, Viacom Networks Brazil and the MTV Networks Digital Suite, a package of five digital services -- MTV Jams, MTV Hits, VH1 Soul, VH1 Mega Hits and Nickelodeon's GAS (Games and Sports for Kids). MTV Networks Latin America also connects with its audiences interactively through its websites: www.mtvla.com, www.mundonick.com and www.vh1la.com, as well as through its broadband and community sites: www.mtvrevolution.com and www.lazona.com.

Amanda Ospina, exec director of TVMAS and Only Telenovelas Fiction & Formats, two trades serving Latin America and Spanish-speaking television in the EEUU, observes animation has increased in these regions with "a lot of bad quality." Cablers holding onto first runs of shows diminished buyers' choices. She says that is changing and the quality has been improving in the last two years because, "Pay TV is buying more animation from Canada, France, Spain, Mexico, and of course Japan, which as gotten a bigger piece of the market."

"The animation market has grown the last two years on free TV, but not as well as the directors and producers would like it to," said Ospina. Producers in Argentina, Mexico and Columbia particularly want to sell programming, but find it hard to do so. The countries she finds most love animation are Brazil, Chile, Argentina, Mexico, Costa Rica and Columbia.

Disney is a relative newcomer to the area. The Disney Channel (DC) has been in the market since 2000 as a premium channel, and, in 2003, started transitioning to become a basic ad-supported channel. "The success of DC was very rapid -- DC rose to the top consistently as it achieved basic distribution, according to Carolina Guevara Lightcap, svp, programming and creative affairs of The Walt Disney Co. Latin America.

"In the case of Jetix, we rebranded the channel in 2004, and have seen impressive ratings growth since then," Lightcap continued. "In fact, both DC and Jetix reached their best ratings ever in 2006. Disney Channel has been the #1 pan-regional channel in 2006, not only with kids, but also with families and people of all ages, since DC leads in households and cable universe as well.

Jetix Latin America is a 24-hour basic kids channel transmitted in Spanish and Portuguese, reaching 15 million households in 19 countries throughout the region via cable and satellite. Jetix Latin America is part of TWDC Latin America and is committed to delivering action/adventure programming, as well as live-action and animated action and adventure, mystery, comedy and anime. The channel also has the support of two websites, www.foxkidstv.com (Spanish) and www.foxkids.com.br (Portuguese). Press can receive additional information on our specialized websites: www.foxkidspack.com (Spanish) and www.foxkidspack.com.br (Portuguese).

The Disney Channel presents a variety of original and acquired programming, airing 24 hours a day, for kids 2-14 and their families. The channel broadcasts three exclusive original productions: Playhouse Disney, Art Attack and Zapping Zone, in addition to cartoons series feature films, Disney's animated hits and special events. The channel has the support of two websites, www.disneylatino.com (Spanish) and www.disney.com.br (Portuguese). Press can receive additional information on our specialized websites: www.disneychannelpack.com (Spanish) and www.disneychannelpack.com.br (Portuguese).

When asked if kids of the region agree with American tastes or shows that perform well in Spain, Light cab responded, "We find that kids shows have a degree of universality, although popularity ranges from market to market. For that reason, we program four feeds for Disney Channel: Mexico, Brazil, South (focused on Argentina), and multicountry. We tailor our programming grids and our local productions specifically to each feed, with excellent results.

"Often, we also see hits across the region, such as High School Musical, which became the most-watched movie ever on DC among kids 4-17 (average audience) in all Latin American territories measured by IBOPE," she said.

Disney Channel has been producing in Latin America since its launch in 2000, and has consistently been the channel with the most local production in the region," she claims.

"We produce a daily show, called Zapping Zone, targeted to tweens." There are three local versions tailored to Mexico, Brazil and Argentina, with local hosts in each case, who have become well-known celebrities in each of the territories.

Its daily pre-school block, Playhouse Disney, is also hosted by popular hosts from Mexico, Brazil and Argentina, in each of its versions. "We also produced Art Attack, with Spanish and Portuguese-speaking hosts; and continue to produce interstitials and image campaigns shot in each of our key territories," said Lightcap.

"In the case of Jetix, since we acquired the channel we have been producing the largest kids sports event in the region -- Copa Jetix (Jetix Kids Cup)," she continued. "We produce up to 16 one-hour shows per year, as well as numerous interstitials, in each language, Spanish and Portuguese, with popular local hosts as well." These productions have received numerous local and international awards.

In regards to animation, Disney/Jetix produces interstitials series locally. "We're very interested in acquiring and developing more locally produced animation, but the supply is still much more abundant for live-action shows, based on the region's production capabilities," she said. They do have locally-produced animated movies that will air on DC, through Patagonik and Miravista.

Disney co-owns Patagonik, a studio based in Argentina, and also owns Miravista, which produces movies in the rest of Latin America, with a focus on Brazil and Mexico. All kid-targeted product from Patagonik and Miravista will be aired by Disney in Latin America.

Patagonik's most recent kids-targeted release, a mix of live-action and CGI animation, was Raton Perez, which was a theatrical success, according to Lightcap. Patagonik is also producing El Arca, an animated feature for release in July.

In the case of Miravista, the first animated movie developed in the region is Turma da Monica, a co-production with famous Brazilian animator Mauricio de Souza, based on the most popular Brazilian animated character. Turma da Monica is premiering in Feb. 2007 in Brazilian theaters, and will eventually be aired on Disney Channel as well.

On the live-action side Disney has acquired local shows, such as kid/tween telenovelas Floricienta (launched on DC in 2004) and Chiquititas (launched in 2006).

"Local production is what has distinguished DC since its launch," she said. "In the future, we plan to continue to increase our local production in the region."

Discovery Kids is the first and only 24/7 network in Latin America dedicated 100% to the youngest of viewers with a mix of educational animated and live-action content designed to foster curiosity and a lifelong love of learning. Discovery Kids has been providing quality children's content to kids and families in Latin America since 1996, and now reaches 17 million subscribers in more than 30 countries across the region.

Discovery Kids has formed strategic alliances with some of the world's leading creators of children's content, including a partnership with the world-renowned Sesame Workshop to produce 65 new regional episodes of Plaza Sésamo, a culturally-relevant Latin American version of Sesame Street. The partnership with Sesame Workshop also enabled the development of related off-air projects, such as the "Healthy Habits for Life" campaign, which was launched in Mexico in 2005.

Also in 2005, Discovery Kids launched a new integrated on and off-air image. In addition to an energetic on-air presence with vivid colors and modern graphics, the channel launched a new on-air "host" in the form of Doki, a friendly and curious animated dog who leads children through the channel environment.

Discovery Kids has developed unique original series in the region as co-productions, including Save-Ums!, Paz and Peep.

In 2004, Discovery Kids launched Ronda Discovery Kids, an interactive tour that allows children to enter the world of their favorite characters through fun and educational games. Ronda Discovery Kids has visited 17 Latin American cities, attracting over 500,000 visitors per year.

The production side of broadcaster Televista took a look at what was happening with animation and decided to get into animation production due to the merchandising opportunities and to be innovative.

"After four years of dealing with ancillary business directly we saw there is a huge opportunity there for this kind of product," said Maca Roter Alday, md of Televisa Licensing & Home Ent.

With the impact of cable channels offering premieres of animated programming that then moved onto terrestrial stations, Televisa decided to change its strategy. "We started with an exclusive window for open TV," she said, which was particularly appealing to their longtime clients, before having it go on to cable.

They started with an animated version of Chavo, a live-action show that's been known for 20 years. Alday said, "We gave it a new look, brought colors, to attract new generations to a well-known brand," something they thought would be easier to sell than a unique product. The 26x30 series is written by Roerto Gomez Bolanos, creator of the original TV show.

Commenting on the launch of kids cable channels in Latin America, Dan Waite, vp international sales, DIC Ent., said, "Some had rougher starts than others. Some went in like gangbusters. And they found their niche. As you can see everyone's stayed in the market. Latins are faithful to good programming. What is popular in the U.S. will fly there."

Waite said the competition has been good for all so that people get better at what they're doing. He enjoys selling to cable and then free TV because, "It helps cover the costs of the dubs. It's been great."

Localizing can be confusing and demanding. In the case of Strawberry Shortcake, it has four different names in Spanish and then Portuguese. "There is a different name in the north of South America and different one in the south and different name in Mexico," he said. "The toys that go in the stores have the same name on the box as what she's called in that region."

While he sells to all over, Waite identifies the key markets are Mexico and Brazil, which are the best paying countries.

While some channels only have a half-hour of animation a day, others are devoting more slots. A channel in Mexico City, Canal Once (XEIPN-TV), is moving into more animation with its own "Once Ninos" block of programming.

In order to sell to the region he said, "You've got to have great relationships with the people. You have to understand their culture and go down there and see them, be on their own turf too. That's always helpful."

Waite is a veteran in the region, selling Filmation cartoons in the '80s. He went on to work for Televista, Radio Caracas in Venezuela, then went back to selling novellas and is now back to selling cartoons for DIC.

"The relationships are still there," he said. "They go through ups and downs economically or presidentially. You stick by them during the good times and the bad times and they'll keep buying form you."

The cabler longest in the region is Cartoon Network. A year after Cartoon Network launched in the U.S., Cartoon Network Latin America was introduced on April 23, 1996, which was Children's Day in Mexico, under the guidance of Cindy Kerry, vp of programming and acquisitions. It began with 500,000 subscribers.

Cartoon Network Latin America is Turner Broadcasting System Inc.'s 24-hour cable and satellite service offering animated entertainment from the world's largest cartoon library and original programs. It is available in 20.3 million households in the region. Turner soon followed with Boomerang another 24-hour cable/satellite network, offering new animated and live-action programming for kids and young teens, featuring sitcoms and series, movies and cartoons. Boomerang is currently available in 14.6 million households throughout Latin America, broadcast in English, Spanish and Portuguese.

CN started out running the Hanna-Barbera cartoons. "We had great success with Hanna-Barbera library," said Kerry. When that ran that course for a while they acquired third party cartoons.

Being the first, "We had a lot of bridges to cross, mainly being a satellite and cable broadcaster," admitted Kerry. "We needed to find a way that was different and fresh that would justify the audience taking us. Why would kids want to watch us over the free TV broadcast."

What attracted them she said was the Cartoon Network environment. "Viewers came into the world of Cartoon Network where kids were able to just release and just have fun." Kerry said she found they had a huge audience of adults watching CN as well, even though the core audience is 6-11.

"As others came into the market, we had to find what would make us unique," said Kerry commenting on the competition. So CN started to bring in shows from other sources and animated movies.

What she was excited about now is the relaunch of Boomerang on April 3, 2006, taking it from an animation only channel to one running live-action shows, movies, sitcoms as well. "It's just so exciting because we've always concentrated on total animation so now we have a whole new genre of product to bring to the network," she said.

Going to NATPE now is a whole new world for her as she puts together movie packages from NBC/Universal, Sony, Warner Bros. But she isn't buying strictly from the majors, "We've got some great movies from independent distributors," she said, adding that she'll buy one-offs.

Kerry said Brazil is fantastic market for CN, which is known for having a sense of humor, a little bit naughtiness. "We are not there to teach, we like the children to learn to have fun with us and know that it's OK to laugh. We like to let viewers just relax; let life pass by for minute. We are the place just to be kids"

The new Boomerang is positioned strongly toward the pre-teenage girls audience, but it's for boys as well with sitcoms like Blue Water High and a new show coming up, Flight 29 Down, which is like a Lost for kids.

"We recognize who our audience is, the lives that they live, the trials they have and we try to address those through the shows we exhibit to them," said Kerry. "It influences them in some way. When they watch us they're going to relate to their own lives."

When buying for the region, she said she found kids don't especially follow U.S. tastes, so they bring in product from all over world. Many shows come from Australia and Europe. If it's popular anywhere in the world, it will probably be popular in another region; it just means it's a good show, according to Kerry.

"A lot has to do with the dubbing," she said. You need to be careful with the adaptation, she warns, "I f you have a bad adaptation you can kill a show. It's like having a bad script." So they work carefully with distributors to make the best product for their shows in all languages. They do Spanish and Portuguese and distribute an English version for the Caribbean.

CN has been active in many coproductions, including Pixcodelics with MoP Brasil Digital, Patoruzito with Red Lojo Ent. in Argentina and Santo Contra los Clones with Brazil and Mexico. Most are short-form series and they've taken popular comic strips and animated them.

Kerry says they use many animation studios throughout the region to do pieces, especially for packaging. "Packaging can dictate whether the audience will sit and wait for a show to begin," she emphasized. "We've got very talented people in Atlanta that know the different studios throughout Latin America who will do that work that will represent and play well on our Cartoon Network and Bomerang."

"Our audience is our packaging," said Kerry, explaining that kids from various countries are used in the packaging spots.

As competition came into cable market she said, It just made us smarter as to which cartoons we bought, because then we concentrated to make sure what we were acquiring was going to be exactly what the audience would want to come into us over the competition.

She thinks free TV has the best of all worlds; they can buy from all the cable channels. Turner is putting blocks of Cartoon Network on free TV, and cross promoting to drive viewers to both destinations.

Cartoon Network had one of the first website destinations for kids and is now active in doing VOD and was the first to launch mobile content in Brazil. "That has opened up new windows for us," said Kerry.

I don't just buy from majors," she said, "Look at my grids, I take these to my meetings." I wouldn't have a full schedule if I was only buying from the majors. I have two 24-hour networks to program. I have room for so much product and am looking for so many genres." She added, "It is unfortunate if distributors don't know that, then I haven't done my job properly."

She acknowledges she's entering the movie buying world late, but she wants the best movies. "We have not positioned ourselves as a live-action movie channel, but we have great channel, with great time periods seven days a week." She's primarily looking for movies targeting girls 11-14. She is looking for animation or fantasy, something that can't happen in your life, like a Harry Potter or Stuart Little.

"My job is fantastic I get to talk to so many people," she exclaimed. "I will talk to people who maybe only have one movie, but if that one movie is fantastic, I'm talking to them."

Kerry added, "I want to be known as the destination for characters, not just the show."

What, besides possible government support and regulations requiring more kids content may be in store for Latin America?

Nick's Rodriquez said, "There will be more channels coming soon to the region."

Sarah Baisley is editor-in-chief of AWN.